We help Fund Administrators to deliver exceptional, client-centric service with the support of cutting-edge, scalable technology.

Fund administrators currently process millions of documents a year and critical client data is almost always trapped in PDFs with inconsistencies in quality, format and terminology. The failure to modernize data operations leads to huge manual efforts and too often results in:

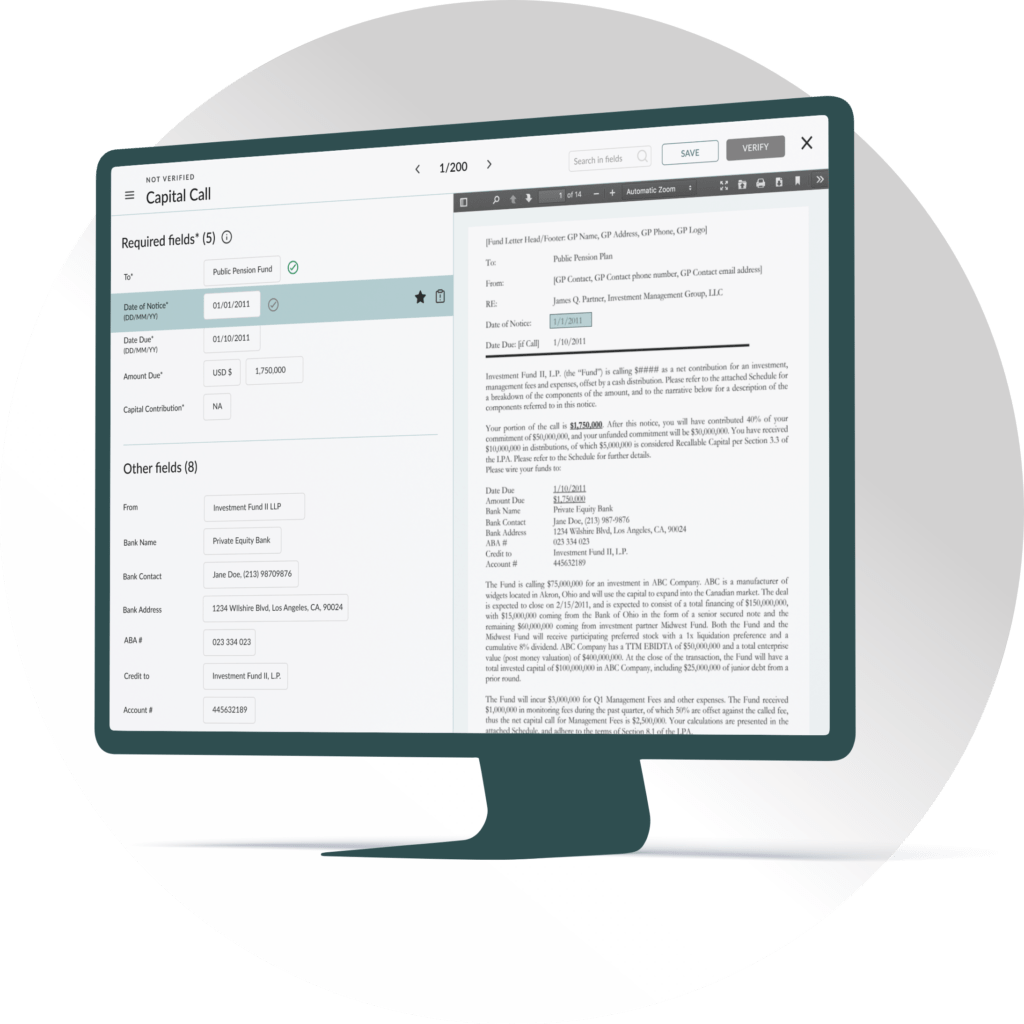

Our award-winning technology leverages the latest advancements in artificial intelligence and machine learning to understand client documents and their data, agnostic of layout.

Our algorithms have been trained by domain experts using over half a million data points across private market documents so you can achieve high performance results from day one.

Automatically capturing up to 200x more data points from your documents

Minimizing manual intervention and delivering consistent outputs with in-built normalization

Capturing and tracking capital events, proceeds and valuations across multiple document types

Drilling through your client fund holdings and investment structures with advanced entity relationships

Cash Flow Notices

Capital Account Statements

Quarterly Financial Statements

Custodian Reports