Process data up to 75x faster

Increase data breadth by over 50x

Dashboard

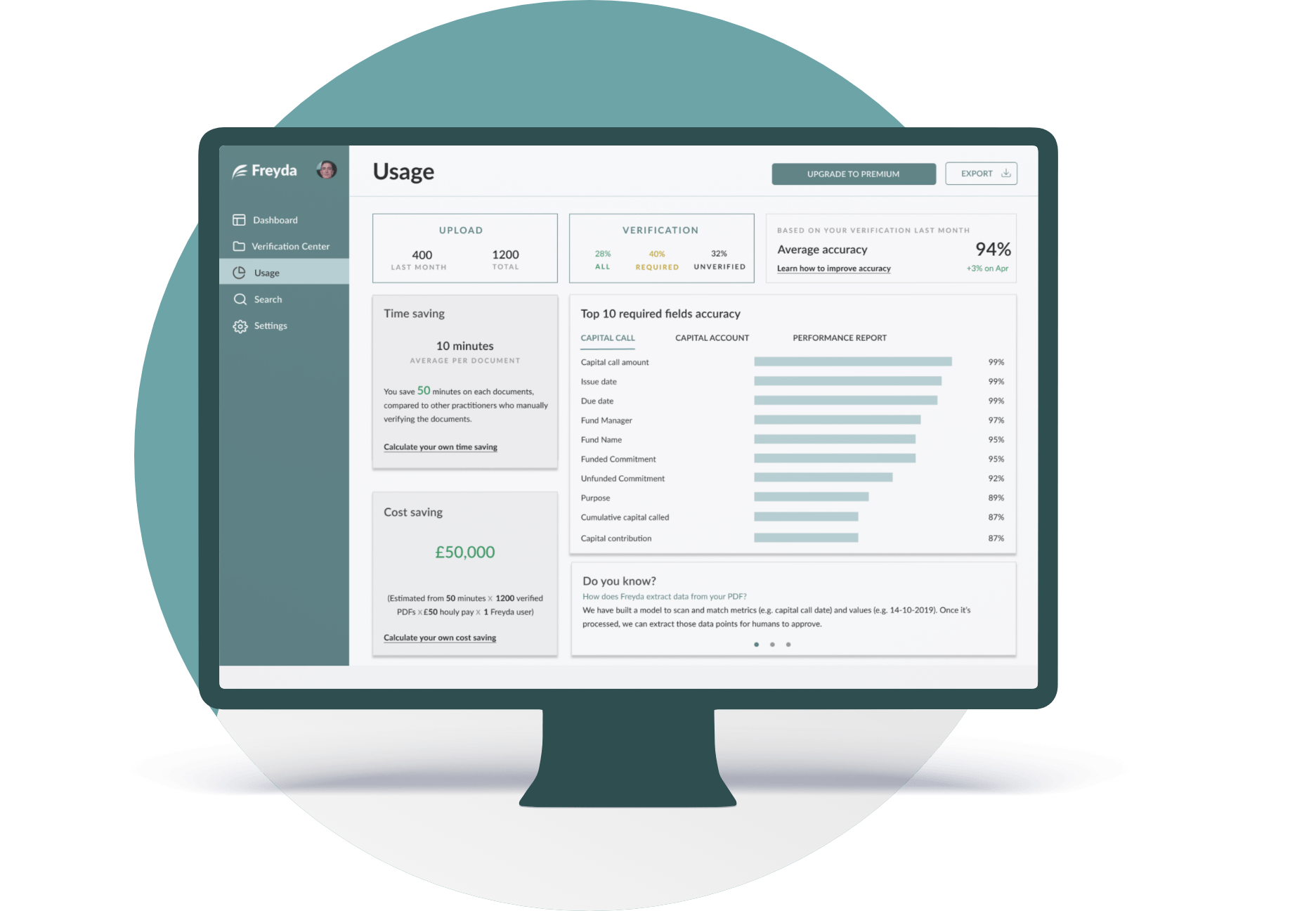

Monitor usage and accuracy in real-time

Our AI solution increases productivity by helping you process data up to 75x faster.

Reduce outgoings by up to 90% with best-in-class automation. Our dashboard gives you real-time transparency over your savings.

Want to maximize your returns and reduce human error? Built to securely handle the most sensitive data across the private equity industry.

With a focus on insights, our machine learning algorithms extract and normalize key information from documents. Say goodbye to obscure data and hello to smart investments.

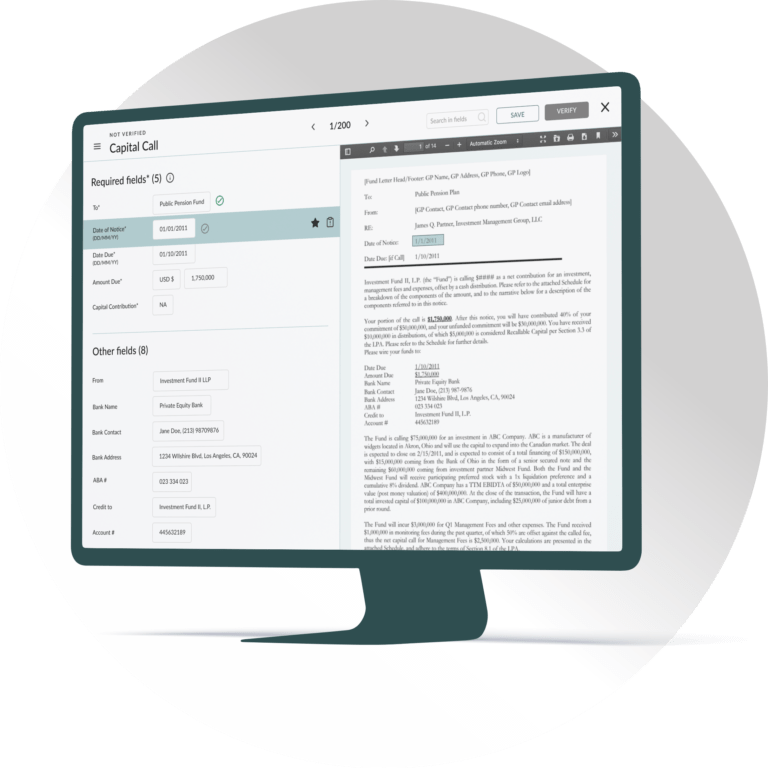

Extract unstructured document data from a variety of formats.

Dynamic comprehension that adapts with your business.

We combine human expertise with machine power to improve accuracy.

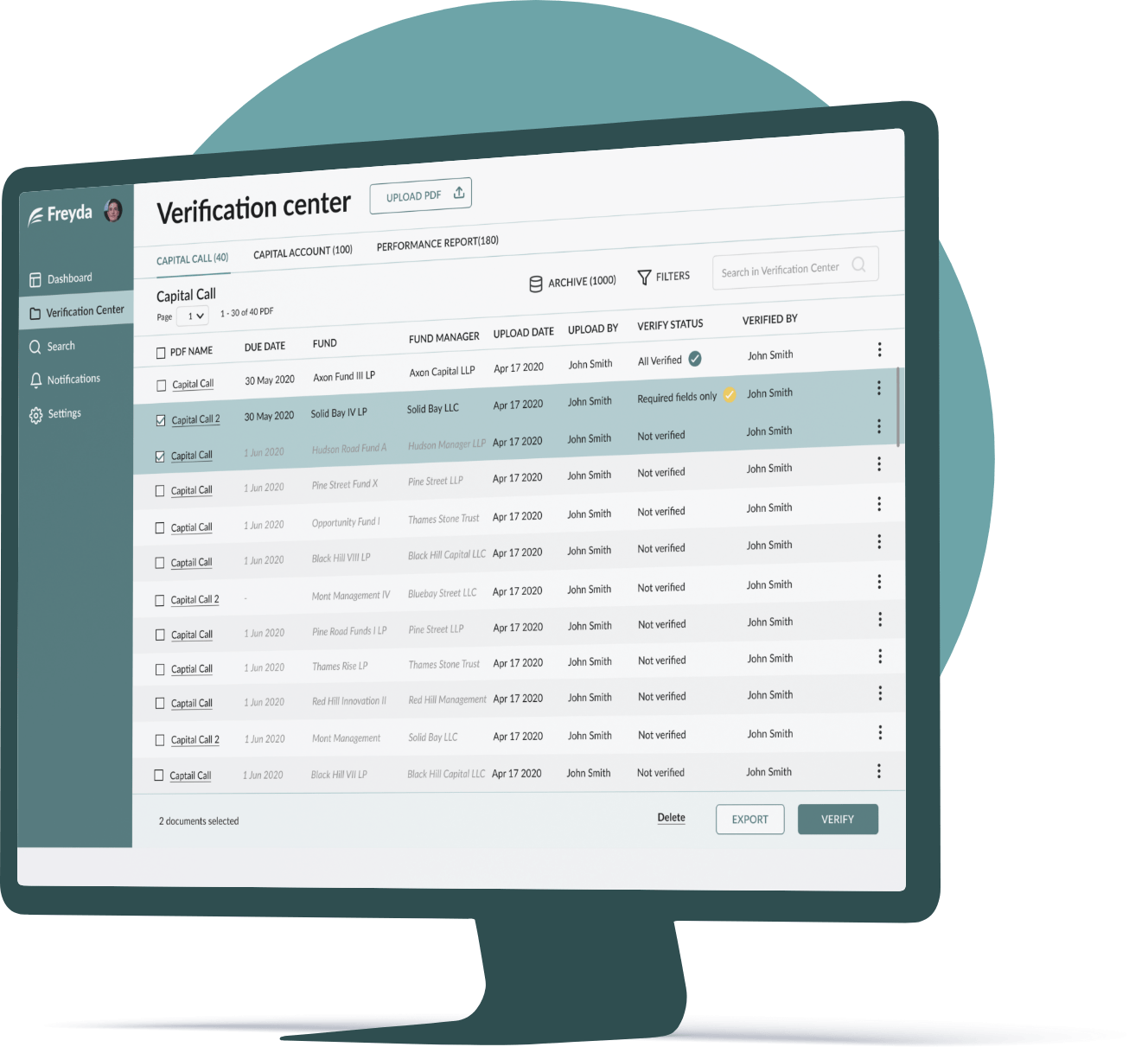

Find critical information and crucial insights with easily searchable data.

Take action with anomaly detection and new trading opportunities.

Say goodbye to manual data entry by integrating us into existing workflows.

Revolutionize operational efficiency and effective decision-making with Freyda.

Utilise state-of-the-art machine learning to recognize, extract and normalise your data.

It’s never been simpler to find the data that is most relevant to you.

Our intuitive dashboard gives you instant access and unique insights into your portfolio.

Automated processing brings clarity to data review and audit processes.

Easily integrate using our APIs or export your data in multiple formats for subsequent reporting and analysis.

AI software for private equity refers to advanced technology solutions that leverage artificial intelligence, machine learning, and predictive analytics to enhance investment strategies and portfolio management. This software automates and streamlines complex processes such as due diligence, risk assessment, and performance monitoring by rapidly collecting, processing and analyzing vast amounts of structured and unstructured data. The insights derived help private equity investors to identify emerging market trends, uncover hidden investment opportunities, and make data-driven decisions that optimize returns.

Freyda is an advanced intelligence platform that automates data collection, data extraction and operational workflows for alternative investment professionals. There are many benefits to using Freyda and AI tools for your portfolio, to name a few, improved data accuracy, reduced manual effort, faster decision-making, seamless scalability, and real-time insights from adopting an AI solution like Freyda. By automating data collection, extraction, and workflow management, Freyda enables alternative investment professionals to streamline operations, enhance reporting efficiency, and unlock deeper portfolio intelligence, allowing teams to focus on high-value analysis and strategic growth.

Freyda helps alternative investment professionals overcome key data challenges by automating the extraction, standardisation, and processing of complex financial data. Our platform addresses:

Manual data entry – Eliminating time-consuming, error-prone processes by automating data extraction from fund reports, investor statements, and other unstructured documents.

Data inconsistencies – Standardising data across multiple formats, sources and terminology to ensure accuracy and consistency in reporting.

Workflow inefficiencies – Automating repetitive tasks and streamlining operational workflows to improve team productivity and scalability.

Slow decision-making – Providing real-time access to structured data to accelerate deal analysis and enhance investment decisions.

Integration bottlenecks – Seamlessly connecting with your existing document management systems, data storage, accounting software, portfolio management systems and CRMs for a unified data ecosystem.

By tackling these challenges, Freyda empowers operations and data teams to improve efficiency, reduce risks, and scale with confidence.

Freyda supports a wide range of document types commonly used in alternative investments, including:

Fund reports – Capital account statements, NAV reports, fund performance reports.

Investor reporting – Capital call notices, distribution notices, quarterly investor reports.

Financial statements – Balance sheets, income statements, cash flow statements.

Portfolio company data – Management reports, valuation reports, operational KPIs.

Bank and transaction documents – Custodian reports, wire confirmations, bank statements.

Invoices & expense reports – Fund administration invoices, management fee statements.

SOIs (Schedule of Investments) – Detailed breakdowns of portfolio holdings and asset allocations.

Subscription & tax documents – Subscription agreements, K-1s, tax statements.

Freyda supports a wide range of investment strategies across alternative asset classes, enabling firms to automate data extraction and streamline operational workflows. Our platform is designed to handle:

Private Equity – Primaries, co-investments, GP-led secondaries, and LP-led secondaries.

Private Debt – Direct lending, mezzanine financing, distressed debt, and special situations.

Real Assets – Infrastructure, real estate, and natural resources.

Hedge Funds – Long/short equity, global macro, event-driven, and multi-strategy funds.

Fund of Funds – Aggregated reporting across multiple underlying managers.

Impact & ESG Investing – Data extraction and reporting aligned with ESG frameworks.

By supporting these diverse strategies, Freyda enables operations and data teams to efficiently manage complex investment data while ensuring accuracy, consistency, and scalability.

Freyda seamlessly integrates into your existing technology stack, enhancing rather than replacing your current systems. Our platform connects with leading data warehouses, portfolio management systems, CRMs, and reporting tools via APIs, allowing for automated data ingestion and synchronisation. Whether you use spreadsheets, cloud-based solutions, or proprietary systems, Freyda standardises and structures unstructured data, reducing manual processing and improving workflow efficiency. With flexible deployment options and minimal IT overhead, Freyda ensures a smooth integration process, enabling your operations and data teams to scale effortlessly while maintaining data consistency across all platforms.

At Freyda, we understand that data security is paramount to your business., especially when dealing with advanced technologies like artificial intelligence (AI). With our state-of-the-art security features, you can trust that your sensitive information is protected at every level. Our robust security measures are designed to meet the highest standards, ensuring compliance with regulations like GDPR and providing peace of mind.