We help Limited Partners unlock actionable insights, underlying asset exposures and true portfolio performance.

You need transparency to support portfolio construction, investment decisions and performance monitoring but data is almost always trapped in PDFs with inconsistencies in quality, format and terminology.

The failure to modernize workflows leads to huge manual efforts that are low latency and prone to error and, as the world shifts to a data driven economy, it’s no longer acceptable for your critical data to remain trapped in your documents.

But what if there was another way?

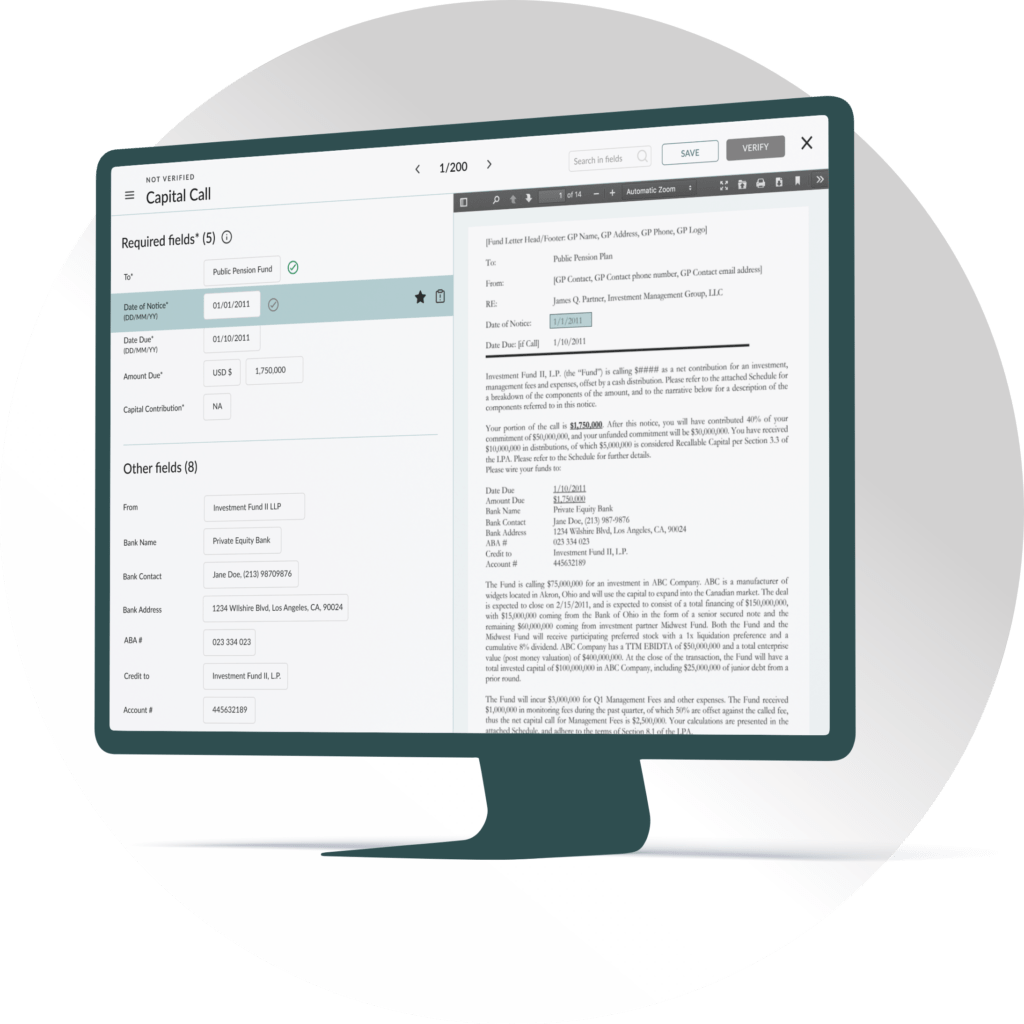

Our award-winning technology leverages the latest advancements in artificial intelligence and machine learning to understand your data, agnostic of layout.

Our algorithms have been trained by domain experts using over half a million data points across alternative investment documents so that you can achieve high performance results from day one.

Accessing up to 200x more data points from your documents

Delivering consistent outputs with in-built normalization

Capturing and tracking capital events, proceeds and valuations across multiple document types

Drilling through your fund holdings and investment structures with advanced entity relationships

Capital Call & Distribution Notices

Capital Account Statements

Quarterly Financial Statements

LPAs & Side Letters